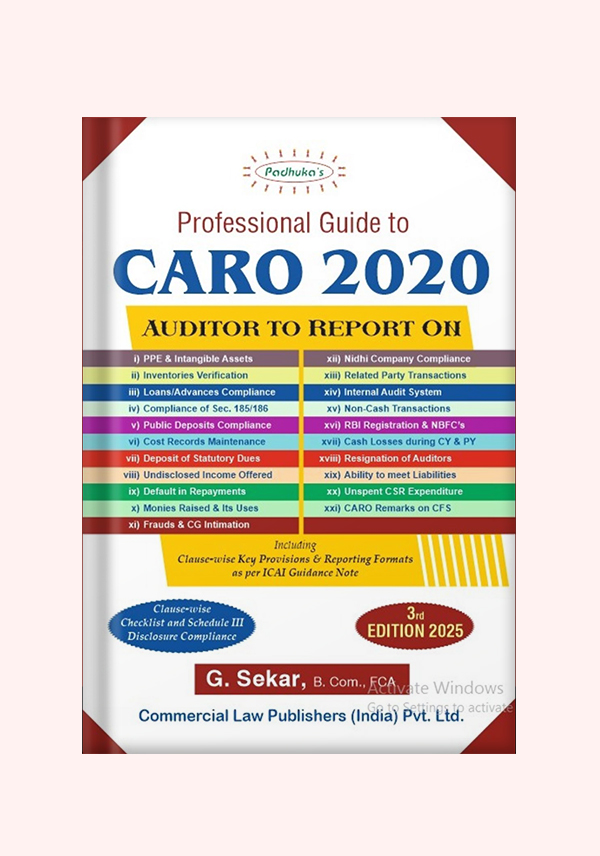

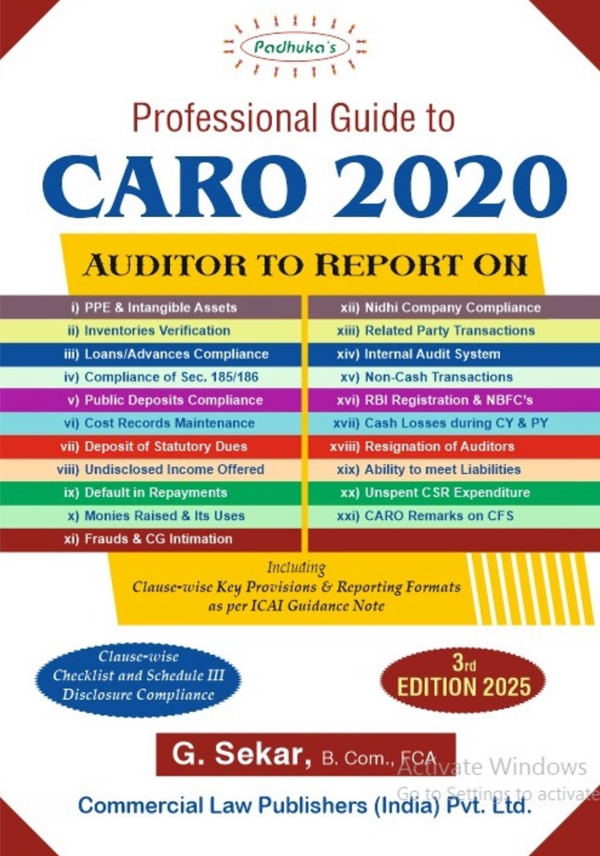

ABOUT Professional Guide to CARO 2020

1 Introduction to CARO – 2020…………………………… 1.1–1.18

2 Applicability of CARO – 2020…………………………… 2.1–2.32

CLAUSE BY CLAUSE ANALYIS

3.1 Clause 1 – Reporting on PPE & Intangible Assets 3(i).1–28

3.2 Clause 2 – Reporting on Inventories 3(ii).1–22

3.3 Clause 3 – Reporting on Loans / Advances 3(iii).1–20

3.4 Clause 4 – Reporting on Compliance of Sec.185/ 186 3(iv).1–4

3.5 Clause 5 – Reporting on Public Deposits 3(v).1–34

3.6 Clause 6 – Reporting on Cost Records 3(vi).1–10

3.7 Clause 7 – Reporting on Statutory Dues 3(vii).1–18

3.8 Clause 8 – Reporting Undisclosed Income Offered 3(viii).1–16

3.9 Clause 9 – Reporting Default in Payments 3(ix).1–22

3.10 Clause 10 – Reporting on Monies Raised and its End Use 3(x).1–34

3.11 Clause 11– Reporting on Frauds 3(xi).1–24

3.12 Clause 12 – Reporting on Nidhi Companies 3(xii).1–30

3.13 Clause 13 – Reporting on Related Party Transactions 3(xiii).1–16

3.14 Clause 14 – Reporting on Internal Audit 3(xiv).1–8

3.15 Clause 15– Reporting on Non Cash Transactions 3(xv).1–8

3.16 Clause 16 – Reporting on RBI Registration & NBFC’s 3(xvi).1–12

3.17 Clause 17– Reporting on Cash Losses 3(xvii).1–4

3.18 Clause 18 – Reporting on Resignation of Auditors 3(xviii).1–26

3.19 Clause 19 – Reporting on ability to meet Liabilities 3(xix).1–10

3.20 Clause 20 – Reporting on CSR 3(xx).1–16

3.21 Clause 21– Reporting on CFS 3(xxi).1–4

4 Para 4 of CARO – 2020………………………………… 4.1–4.12

APPENDIX

Appendix 1 – Comparison between CARO 2016 vs 2020… A.1–A.20

Appendix 2 – Standards On Auditing

(SA 240, 250, 315, 550, 570, 610, 700, 701, 705, 706) SA.1–222

Appendix 3 – ICAI Guidance on Audit Matters

Guidance on Reporting under Sec. 143(3) (f) & (h)…… GN.1–15

Appendix 4 – Reporting Guidance under ICAI GN R.1-R.30

Detailed Contents

Reviews

There are no reviews yet.