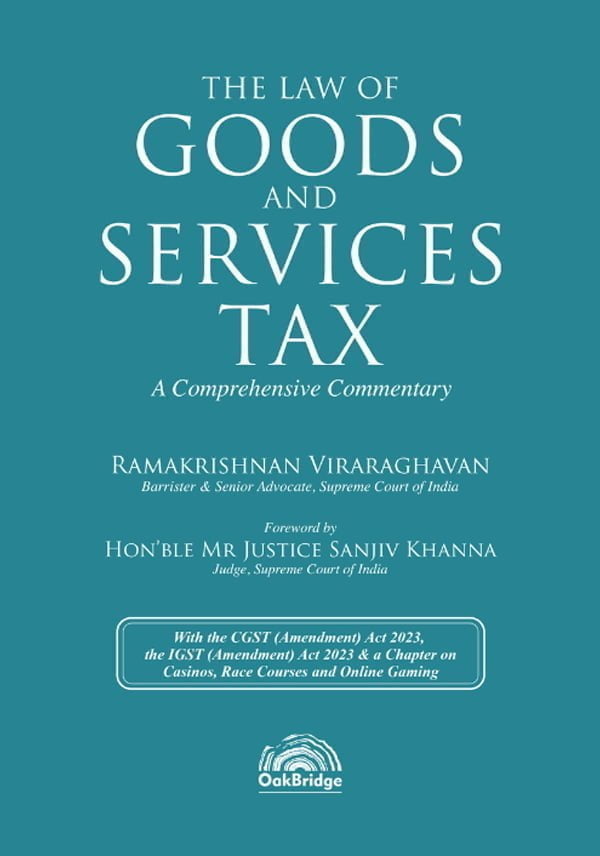

CONTENTS AT A GLANCE

VOLUME 1

CHAPTER 1 : CONSTITUTION & GST 1

CHAPTER 2 : STATUTORY MEANINGS AND ADMINISTRATION 66

CHAPTER 3 : LEVY & COLLECTION 111

CHAPTER 4 : TIME & VALUE OF SUPPLY 236

CHAPTER 5 : INPUT TAX CREDIT 286

CHAPTER 6 : REGISTRATION 371

CHAPTER 7 : INVOICE, ACCOUNTS & RECORDS 423

CHAPTER 8 : IGST & PLACE OF SUPPLY 498

CHAPTER 9 : RETURNS 601

CHAPTER 10 : PAYMENT OF TAX, INTEREST, PENALTY & OTHER

AMOUNTS [SECTION 49] 655

CHAPTER 11 : REFUNDS 681

CHAPTER 12 : ASSESSMENTS 745

CHAPTER 13 : AUDIT 754

CHAPTER 14 : INSPECTION, SEARCH, SEIZURE & ARREST 766

CHAPTER 15 : DEMAND AND RECOVERY OF TAX 802

CHAPTER 16 : LIABILITY TO PAY IN CERTAIN CASES 864

CHAPTER 17 : ADVANCE RULING 875

CHAPTER 18 : APPEALS 895

CHAPTER 19 : OFFENCES & PENALTIES 950

CHAPTER 20 : TRANSITIONAL PROVISIONS 976

CHAPTER 21 : ANTI-PROFITEERING 1010

CHAPTER 22 : MISCELLANEOUS 1043

CHAPTER 23 : SECTORAL IMPACT 1064

CHAPTER 25 : GST CONSTITUTIONAL CASES 1210

VOLUME 2

APPENDICES

APPENDIX 1 CENTRAL GOODS AND SERVICES TAX ACT, 2017 1289 – 1466

APPENDIX 2 CENTRAL GOODS AND SERVICES TAX

(EXTENSION TO JAMMU AND KASHMIR) ACT, 2017

1467 – 1468

APPENDIX 3 INTEGRATED GOODS AND SERVICES TAX ACT, 2017

1469 – 1494

APPENDIX 4 INTEGRATED GOODS AND SERVICES TAX

(EXTENSION TO JAMMU AND KASHMIR) ACT, 2017 1495

APPENDIX 5 UNION TERRITORY GOODS AND SERVICES TAX

ACT, 2017 1496 – 1517

APPENDIX 6 GOODS AND SERVICES TAX (COMPENSATION

TO STATES) ACT, 2017 1518 – 1530

APPENDIX 7 CENTRAL GOODS AND SERVICES TAX RULES, 2017

1531 – 1700

APPENDIX 8 INTEGRATED GOODS AND SERVICES TAX RULES, 2017

1701 – 1712

APPENDIX 9 GOODS AND SERVICES TAX COMPENSATION CESS

RULES, 2017 1713

APPENDIX 10 GOODS AND SERVICES TAX (PERIOD OF LEVY AND

COLLECTION OF CESS) RULES, 2022 1714

APPENDIX 11 GOODS AND SERVICES TAX SETTLEMENT OF FUNDS

RULES, 2017 1715 – 1727

Reviews

There are no reviews yet.