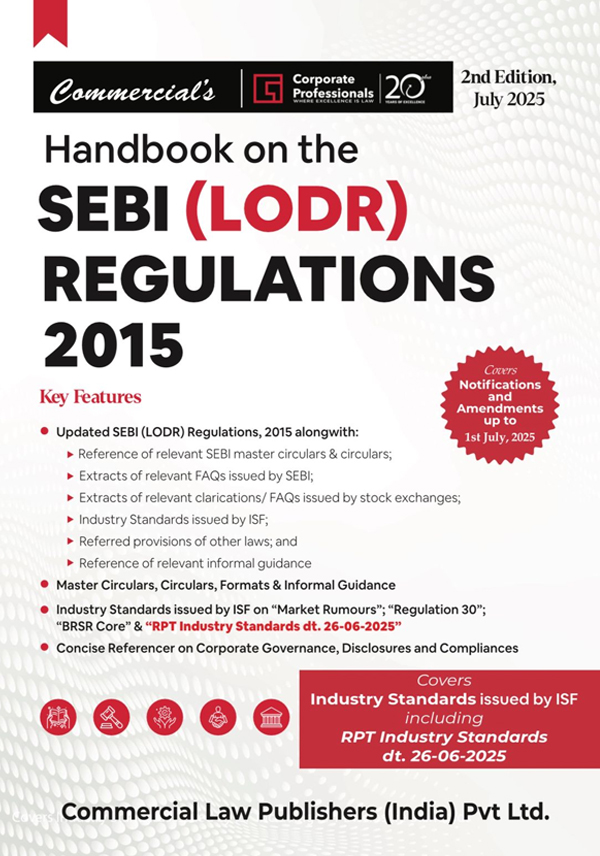

DIVISION 1

Chapter – I Preliminary [Regulations 1 to 3]………………1.1.1

Chapter – II Principles Governing Disclosures and Obligations of Listed Entity [Regulation 4]…………………… 1.1.29

Chapter – III Common Obligations of Listed Entities [Regulations 5 to 14]…………………….1.1.35

Chapter – IV Obligations of [A] Listed Entity Which has Listed its Specified

Securities [and Non-Convertible DEBT Securities] [Regulations 15 to 48]………………………1.1.54

Chapter – V Obligations of Listed Entity which has Listed Its Non-Convertible [Regulations 49 to 62]…………….1.1.394

[Chapter – VA] Corporate Governance Norms for A Listed Entity Which has Listed Its Non-Convertible Debt Securities [Regulations 62B & 62Q] …………………………..1.1.461

Chapter – VI Obligations of Listed Entity which has Listed Its Specified Securities and Either Non-Convertible Debt Securities or Non-Convertble

Redeemable Preference Shares or Both [Regulations 63 & 64]………………………………………1.1.496

[Chapter – VIA] Framework for Voluntary Delisting of Non-Convertivle Debt Securities or Non-Convertivle Redeemanble Preference Shares and Obligations of The Listed Entity on Such Delisting [Regulations 64A- 64I]……………………………………..1.1.498

Chapter – VII Obligations of Listed Entity which has Listed Its Indian Depository Receipts [Regulations 66 to 80]……….1.1.507

Chapter – VIII Obligations of Listed Entity which has Listed Its Securitised Debt Instruments [Regulations 81 to 87]…………………….. 1.1.528

[Chapter – VIIIA] Obligations of Listed Entity which has Listed Its Security

Receipts [Regulations 87A to 87E]……………………………………………………………………………….. 1.1.536

Chapter – IX Obligations of Listed Entity which has Listed Its Mutual Fund Units [Regulations 88 to 91] ………… 1.1.542

[Chapter – IX-A] Obligations of Social Enterprises [Regulations 91A to 91F]………………..1.1.545

Chapter – X Duties and Obligations of The Recognised Stock Exchange(s)

[Regulations 92 to 97]………………………………………………………………………………………………….. 1.1.558

Handbook on the SEBI (LODR) Regulations, 2015

Chapter – XI Procedure for Action in Case of Default [Regulations 98 & 99] ………………..1.1.563

[Chapter – XIA] Power to Relax Strict Enforcement of The Regulations

[Regulation 99A]…………………………………………………………………………………………………………. 1.1.588

Chapter – XII Miscellaneous [Regulations 100 to 103]…………………………………………………..1.1.589

SCHEDULE I – TERMS OF SECURITIES……………………………………………………………………..1.1.592

SCHEDULE II: CORPORATE GOVERNANCE……………………………………………………………1.1.593

SCHEDULE III ……………………………………………………………………………………………………………. 1.1.601

SCHEDULE IV……………………………………………………………………………………………………………. 1.1.624

SCHEDULE V: ANNUAL REPORT ……………………………………………………………………………. 1.1.629

SCHEDULE VI: MANNER OF DEALING WITH UNCLAIMED SHARES…………………..1.1.638

SCHEDULE VII: TRANSFER [AND TRANSMISSION] OF SECURITIES …………………….1.1.640

[SCHEDULE VIII………………………………………………………………………………………………………… 1.1.644

SCHEDULE IX- AMENDMENTS TO OTHER REGULATIONS…………………………………..1.1.646

SCHEDULE X- LIST OF SEBI CIRCULARS WHICH STAND RESCINDED…………………1.1.653

SCHEDULE XI – FEE IN RESPECT OF DRAFT SCHEME OF ARRANGEMENT ………..1.1.662

DIVISION 2

Master Circular No. SEBI/HO/CFD/PoD2/CIR/P/0155 Dated November 11, 2024…………….. 2.1.1

Circular No. SEBI/HO/CFD/CFD-PoD-2/CIR/P/2024/185 Dated December 31, 2024…………….. 2.2.1

Circular No. SEBI/HO/CFD/PoD2/CIR/P/2025/47 Dated April 01, 2025…………………….2.3.1

Master Circular No. SEBI/HO/DDHS/DDHS-PoD-1/P/CIR/2024/48 Dated

May 21, 2024…………………………………………………………………………………………………………………… 2.4.1

Master Circular No. SEBI/HO/DDHS-PoD3/P/CIR/2024/46 Dated May 16,

2024………………………………………………………………………………………………………………………………… 2.5.1

Circular No. SEBI/HO/MIRSD/MIRSD_RTAMB//P/CIR/2022/65 Dated May

18, 2022…………………………………………………………………………………………………………………………… 2.6.1

Circular No. SEBI/HO/MIRSD/MIRSD_RTAMB//P/CIR/2022/70 Dated May

25, 2022…………………………………………………………………………………………………………………………… 2.7.1

Annexure ……………………………………………………………………………………………………………………….. 2.7.3

DIVISION 3

Industry Standards Note on Business Responsibility and Sustainability Report

(BRSR) Core…………………………………….. 3.1.1

Industry Standards Note on Regulation 30 of the LODR Regulations ……………………………..3.2.1

Industry Standards Note on verification of market rumours under Regulation

30(11) of LODR Regulations……………………………. 3.3.1

Industry Standards on “Minimum information to be provided to the Audit

Committee and Shareholders for Approval of Related Party Transactions”

(“RPT Industry Standards”)……………… 3.4.1

DIVISION 4

INFORMAL GUIDANCE ON SEBI (LODR) REGULATIONS, 2015 ………………………………..4.1.1

DIVISION 5

A Corporate Governance………….. 5.1.1

B Disclosures …………………. 5.11.1

C Compliances ……………… 5.15.1

Reviews

There are no reviews yet.