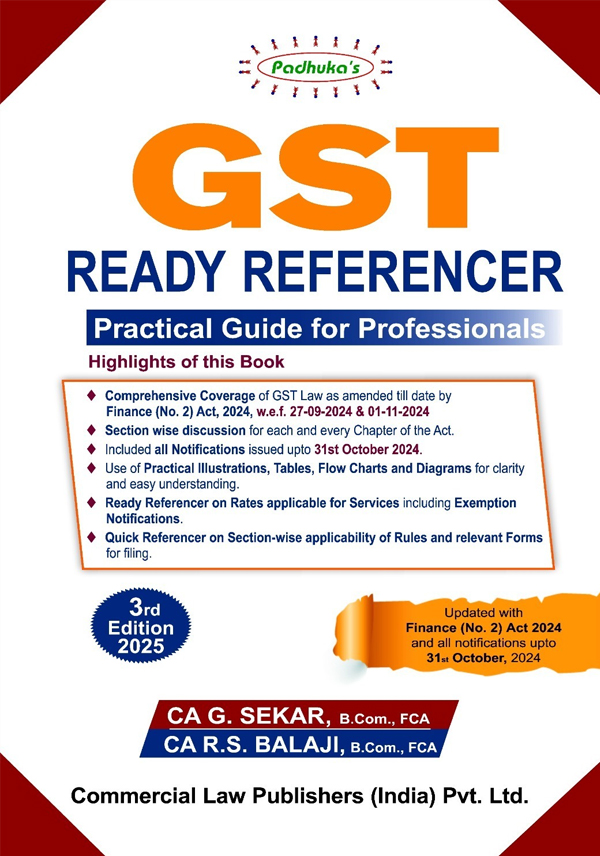

About The Book GST Ready Referencer

Quick Referencer

• Referencer on Section Wise Rules

• Referencer on Section Wise Forms

• Important SC, HC, AAAR Decisions

• Changes by Finance (No. 2) Act, 2024

• Definitions under CGST Act, 2017

GST Law

1. Basic Concepts of GST 1.1 – 1.48

2. GST – Levy and Collection of Tax 2.1 – 2.128

3. GST – Exemptions 3.1 – 3.90

4. Place of Supply 4.1 – 4.48

5. Time and Value of Supply 5.1 – 5.64

6. Input Tax Credit 6.1 – 6.100

7. Registration 7.1 – 7.52

8. Tax Invoice, Credit and Debit Notes 8.1 – 8.32

9. Payment 9.1 – 9.40

10. Liability to Pay Tax in Certain Cases

Reviews

There are no reviews yet.