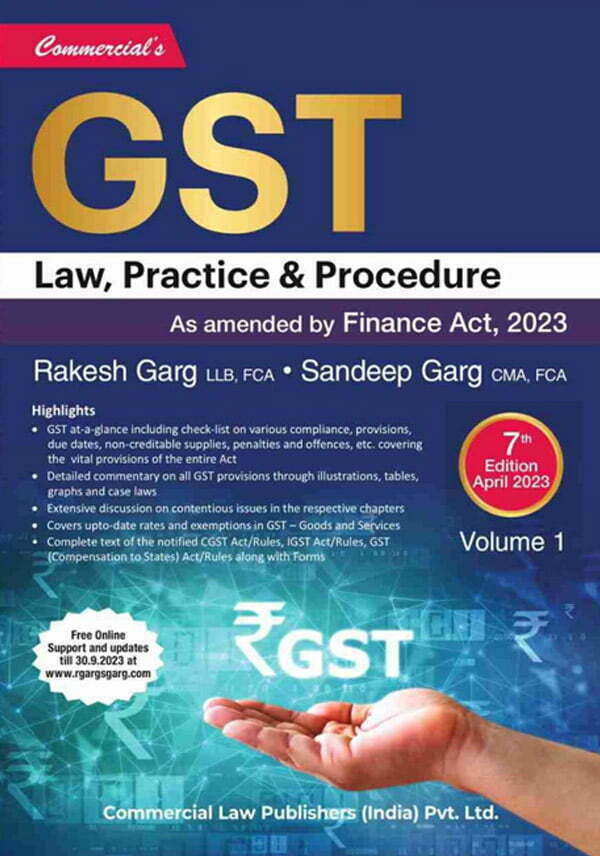

CONTENTS AT-A-GLANCE

About the Authors ……………………………………………………………………………………… v

Preface …………………………………………………………………………………………………. vii

Abbreviations …………………………………………………………………………………………. xii

Table of Contents ……………………………………………………………………………………. xiii

VOLUME 1

PART – A

GST – AT-A-GLANCE A1 GST IN INDIA – AT-A-GLANCE …………………………………………………….A1-1

A2 COMPLIANCE CHART WITH LIMITATION PERIODS UNDER GST …………………………………….A2-1

A3 REVERSE CHARGE UNDER GST ………………………………………………….A3-1

A4 NON-CREDITABLE GOODS/SERVICES AND SUPPLIES (BLOCKED CREDITS)…………. A4-1

A5 PAYMENT OF TAX & RETURNS UNDER GST ……………………………….A5-1

A6 INTEREST, PENALTIES AND OFFENCES ……………………………………..A6-1

A7 STATE CODES……………………………………………………………………………..A7-1

A8 PORT CODES ……………………………………………………………………………… A8-1

A9 SEZ – LIST OF SERVICES RECOGNIZED FOR AUTHORISED OPERATIONS ………………………………………………………………………………A9-1

A10 COMPLIANCE DUE DATES WITH EXTENSIONS AND COVID19 RELATED RELAXATIONS …………………………………………………….. A10-1

A11 GST FORMS – AT-A-GLANCE …………………………………………………….. A11-1

PART – B

COMMENTARY

B1 PRE-GST INDIAN INDIRECT TAX STRUCTURE …………………………… B1-1

B2 GST – CONCEPT, FEATURES AND ADVANTAGES AND CONSTITUTIONAL AMENDMENTS …………………………………………….. B2-1

B3 TAXES OR DUTIES SUBSUMED IN THE GST ……………………………….. B3-1

B4 GST COUNCIL & ITS FUNCTIONS AND ADMINISTRATION OF GST ……………………………………………………………………………………………. B4-1

B5 STEPS TO DETERMINE LIABILITY UNDER GST AND KEY DEFINITIONS …………………………………………………………………………….. B5-1

B6 SUPPLY – MEANING AND SCOPE ……………………………………………….. B6-1

B7 TIME AND VALUE OF SUPPLY ……………………………………………………. B7-1

B8 CONCEPT OF IGST – INTER-STATE SUPPLY AND INTRASTATE SUPPLY …………………………………………………………………………… B8-1

B9 IMPORTS, ZERO-RATED SUPPLIES AND EXPORTS ……………………… B9-1

B10 LEVY, REVERSE CHARGE, RATES AND EXEMPTIONS ………………..B10-1

B11 INPUT TAX CREDIT AND INPUT SERVICE DISTRIBUTOR………….B11-1

B12 COMPOSITION LEVY ………………………………………………………………….B12-1

B13 JOB WORKER, CASUAL TAXABLE PERSON, NON-RESIDENT TAXABLE PERSON & CORPORATE DEBTORS …………………………….B13-1

B14 E-COMMERCE, TCS & SUPPLY OF ONLINE DATA – SPECIAL PROVISIONS ………………………………………………………………………………B14-1

B15 REGISTRATION, AMENDMENT AND CANCELLATION ………………B15-1

B16 RETURNS UNDER THE GST……………………………………………………….. B16-1

B17 PAYMENT OF TAX AND INTEREST …………………………………………….B17-1

B18 TAX DEDUCTION AT SOURCE ……………………………………………………B18-1

B19 REFUND ……………………………………………………………………………………. B19-1

B20 INVOICE, ACCOUNTS AND RECORDS ………………………………………..B20-1

B21 ASSESSMENT, AUDIT & DETERMINATION OF TAX AND ADJUDICATION …………………………………………………………………………B21-1

B22 COLLECTION OF TAX, DEMANDS & RECOVERY AND LIABILITY IN CERTAIN CASES …………………………………………………..B22-1

B23 INSPECTION, SEARCH & SURVEY ………………………………………………B23-1

B24 INSPECTION OF GOODS IN MOVEMENT, CONFISCATION AND E-WAY BILL ……………………………………………………………………….B24-1

B25 PENALTIES AND PROSECUTION ………………………………………………..B25-1

B26 APPEAL, ADVANCE RULING AND ANTI-PROFITEERING PROVISIONS ………………………………………………………………………………B26-1

B27 TRANSITIONAL PROVISIONS ……………………………………………………..B27-1

B28 MISCELLANEOUS PROVISIONS ………………………………………………….B28-1

VOLUME 2

PART – C

LEGISLATIONS C0 FINANCE ACT – 2023 – GST RELATED …………………………………………. C0-1

C1 AMENDED/INSERTED ARTICLES BY THE CONSTITUTION (101ST AMENDMENT) ACT, 2016 …………………………………………………. C1-1

C2 CENTRAL GOODS AND SERVICES TAX ACT, 2017 ………………………. C2-1

C3 CENTRAL GOODS AND SERVICES TAX RULES, 2017…………………… C3-1

C4 THE INTEGRATED GOODS AND SERVICES TAX ACT, 2017 …………. C4-1

C5 INTEGRATED GOODS AND SERVICES TAX RULES, 2017 …………….. C5-1

C6 THE GOODS AND SERVICES TAX (COMPENSATION TO STATES) ACT, 2017 ……………………………………………………………………… C6-1

C7 GST COMPENSATION CESS RELATED RULES …………………………….. C7-1

C8 CGST FORMS ……………………………………………………………………………… C8-1 C9 NON-TARIFF NOTIFICATIONS UNDER GST ………………………………… C9-1

C10 RATES AND EXEMPTION NOTIFICATIONS IN GST …………………… C10-1

C11 ORDERS ISSUED UNDER GST …………………………………………………… C11-1

C12 CIRCULAR, CLARIFICATIONS AND INSTRUCTIONS AND GUIDELINES UNDER GST ………………………………………………………… C12-1

PART – D

GST RATES D1 GST RATES – GOODS …………………………………………………………………..D1-1

D2 GST EXEMPTIONS – GOODS ……………………………………………………….. D2-1

D3 GST RATES – SERVICES ……………………………………………………………….D3-1

D4 GST EXEMPTIONS – SERVICE………………………………………………………D4-1

D5 RATES OF COMPENSATION CESS ……………………………………………….D5-1

D6 SCHEME OF CLASSIFICATION OF SERVICES AND EXPLANATORY NOTES ………………………………………………………………………………………..D6-1

Reviews

There are no reviews yet.