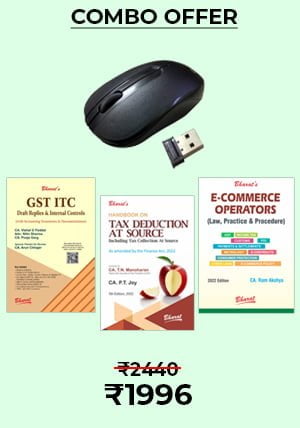

GST ITC Draft Replies & Internal Controls

Chapter 1 Introduction

Chapter 2 Blueprint of Drafting

Chapter 3 ITC related notices and draft replies

Chapter 4 Control Chart — Eligible/Ineligible with Reversal and Blocked ITC

Chapter 5 Due dates of GSTR 3B and Relaxation in late Fees and Interest during COVID

Chapter 6 Internal Control and Reconciliations

Chapter 7 FAQ on New Format of GSTR 3B

Chapter 8 Accounting Entries and ITC Documentations

Chapter 9 TRAN 1/TRAN 2 Guidelines

Chapter 10 CGST Act, Rules and Circulars on ITC

Handbook on Tax Deduction At Source

TDS Rates for FY 2021-22

TDS Rates for FY 2022-23

Tax Calendar for Financial Year 2022-2023

Chapter 1 Collection and Recovery of Tax — Introduction

Chapter 2 Section 192 — TDS on Salary

Chapter 3 Section 192A — Payment of accumulated balance to employees

Chapter 4 Section 193 — TDS from Interest on Securities

Chapter 5 Section 194 — TDS from Dividends

Chapter 6 Section 194A — TDS from Interest other than Interest on Securities

Chapter 7 Section 194B — TDS from Winnings from Lottery or Crossword Puzzle

Chapter 8 Section 194BB — TDS from Winnings from Horse Races

Chapter 9 Section 194C — TDS from Payments to Contractors

Chapter 10 Section 194D — TDS on Insurance Commission

Chapter 11 Section 194DA — TDS from Payment in Respect of Life Insurance Policy

Chapter 12 Section 194E — TDS from payments to Non-resident Sportsmen or Sports Associations

Chapter 13 Section 194EE — TDS from Payments in Respect of Deposits under National Savings Scheme, etc.

Chapter 14 Section 194F — TDS from Payment on account of repurchase of units by Mutual Fund or Unit Trust of India

Chapter 15 Section 194G — TDS on Commission etc., on sale of lottery tickets

Chapter 16 Section 194H — TDS on Commission and Brokerage

Chapter 17 Section 194-I — TDS from Rent

Chapter 18 Section 194-IA — TDS on Payment on Transfer of certain Immovable Property (other than agricultural land)

Chapter 19 Section 194-IB — TDS on Payment of rent by Certain Individuals or Hindu Undivided Family

Chapter 20 Section 194-IC — TDS on Payment under Specified Agreement

Chapter 21 Section 194J — TDS from Fees for Professional or Technical Services or Royalty or Non-Compete Fee

Chapter 22 Section 194K — TDS on Income in respect of Units

Chapter 23 Section 194LA — TDS on Payment of Compensation on Acquisition of certain Immovable Property (other than agricultural land)

Chapter 24 Section 194LB — TDS from income by way of interest from Infrastructure Debt Fund

Chapter 25 Section 194LBA — TDS on Income from Units of Business Trusts

Chapter 26 Section 194LBB — TDS from Income in respect of Units of Investment Fund

Chapter 27 Section 194LBC — TDS from Income in respect of investment in Securitization Trust

Chapter 28 Section 194LC — TDS on Income by way of Interest from Indian Company or the Business Trusts

Chapter 29 Section 194LD — TDS from income by way of interest on certain bonds and Government Securities

Chapter 30 Section 194M — Payment of certain sums by certain Individuals or Hindu Undivided Family

Chapter 31 Section 194N — Payment of Certain Amounts in Cash (Substituted w.e.f. 01-07-2020)

Chapter 32 Section 194-O — Payment of Certain Sums by E-Commerce Operator to E-Commerce Participant (applicable w.e.f. 01-10-2020)

Chapter 33 Section 194P — TDS in the case of Specified Senior Citizen (applicable w.e.f. 01.07.2021)

Chapter 34 Section 194Q — TDS on payment of certain sum for purchase of goods (applicable w.e.f. 01.07.2021)

Chapter 35 Section 194R — TDS on Benefit of Perquisite in respect of Business or Profession (w.e.f. 01.07.2022)

Chapter 36 Section 194S — TDS on Transfer of Virtual Digital Asset

Chapter 37 Section 195 — Other Sums

Chapter 38 Section 195A — Income payable Net of Tax

Chapter 39 Section 196 — TDS from Interest or Dividend or Other Sums Payable to Government, Reserve Bank or Certain Corporations

Chapter 40 Section 196A — TDS from Income in respect of Units of Non-Residents

Chapter 41 Section 196B —TDS on Income from Units

Chapter 42 Section 196C — TDS from Income from foreign currency bonds or shares of Indian Company

Chapter 43 Section 196D — TDS from Income of Foreign Institutional Investors from Securities

Chapter 44 Miscellaneous Provisions of TDS

Chapter 45 Section 206AB — Special Provisions for deduction of tax at source for non-filers of Income Tax Return (applicable w.e.f. 01.07.2021)

Chapter 46 Section 206C — Tax Collection at Source

Chapter 47 Section 206CCA — Special Provisions for collection of tax at source for non-filers of Income Tax Return (applicable w.e.f 01.07.2021)

Chapter 48 Certificate, Statement and Return of Tax Deducted/Collected at Source

Chapter 49 Consequences of Failure to Deduct or Pay

E-COMMERCE OPERATORS (Law, Policy & Procedures)

Chapter 1 Introduction to E-Commerce

Chapter 2 Types of E-Commerce

Chapter 3 Models of E-Commerce

Chapter 4 Functions of E-Commerce Operators

Chapter 5 Applicable Laws on E-Commerce Operators

Chapter 6 GST on E-Commerce Operators

Chapter 7 Income-tax on E-Commerce Operators

Chapter 8 E-Commerce Operators – Customs Law

Chapter 9 E-Commerce Operators — Foreign Direct Investment Policy

Chapter 10 E-Commerce Operators — Law of Payment and Settlement

Chapter 11 E-Commerce Operators — Law of Metrology

Chapter 12 E-Commerce Operators – Law of Consumer Protection

Chapter 13 E-Commerce Operators – Law of e-Contracts

Chapter 14 E-Commerce Operators – Cyber Law

Chapter 15 E-Commerce Operators – Law of Intellectual Property

Chapter 16 National E-Commerce Policy

Appendix 1 The Information Technology Act, 2000

Appendix 2 Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021

Appendix 3 Consumer Protection (E-Commerce) Rules, 2020

Appendix 4 Some Important Judicial Pronouncements with Respect to E-Commerce Operators

Reviews

There are no reviews yet.