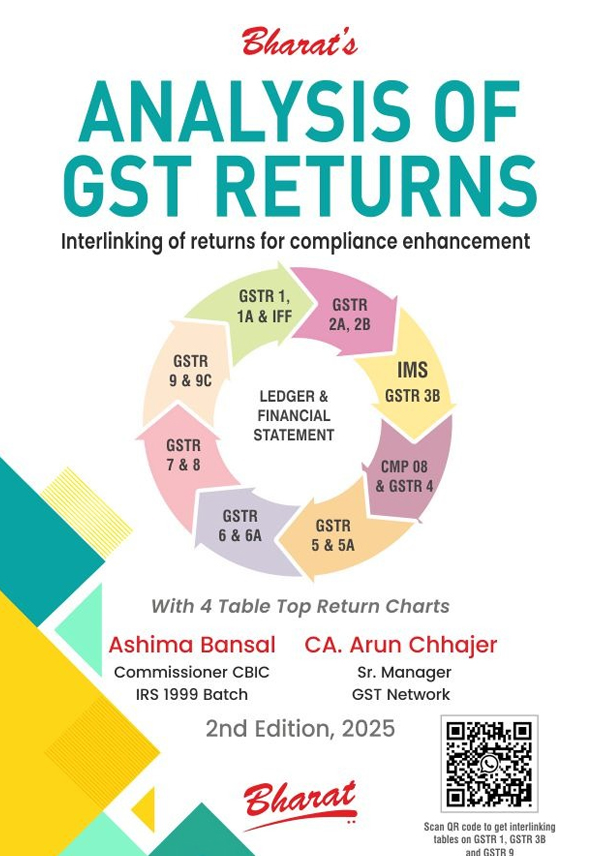

About ANALYSIS OF G S T RETURNS

| Chapter 1 Overview of GST Return Chapter 2 Analysis of GSTR 1 and its Interlinking with GSTR 3B, 9 and 9C Chapter 3 Analysis of GSTR-1A Chapter 4 Invoice Management System Chapter 5 GSTR 2A and GSTR 2B Chapter 6 GSTR 3B and its interlinking with GSTR 1/9/9C Annexure 1 Due Date Chart for GSTR 3B from July 2017 to December 2024 Chapter 7 Analysis of GSTR 9 and its Interlinking with GSTR 3B, 1 and 9C Chapter 8 Analysis of GSTR 9C and its interlinking with GSTR 1, 3B and 9 Chapter 9 CMP-08 and GSTR 4 [Composition Levy Scheme] Chapter 10 GSTR 5 (Non-Resident Taxpayer) Chapter 11 GSTR 5A (OIDAR and Online Money gaming) Chapter 12 GSTR 6 and 6A (Input Service Distributor) Chapter 13 GSTR 7 and GSTR 7A (Tax Deduction at Source) Chapter 14 GSTR 8 (TCS by ECO) Chapter 15 Ledgers, Statements and Reports Chapter 16 Explore the Financial Position: Understanding the P&L, Balance Sheet and Ratio Analysis Chapter 17 Review of Financial Statements |

Reviews

There are no reviews yet.