Agriculture plays a vital role in Indian economy. Except for two short periods of nine years in all (1860-1865 and 1869-1873) agricultural incomes have been exempt from the general income-tax. In 1925, the Indian Taxation Inquiry Committee observed that there is no historical or theoretical justification for the continued exemption from the income-tax of incomes derived from agriculture They found it justified to include agriculture income for rate purposes. It continues unchanged till date. Section 2(1A) of the Income Tax Act, defines “agriculture income” But some incomes are derived partly from agricultural and partly from non-agricultural operations. Also it is difficult to define agricultural operations. Hence a detailed analysis has been given to define taxability of such income under the Income Tax Act.

Tax on agricultural income falls under the State list”, meaning that only State Governments can levy income-tax on such incomes, not the Central Government.

There is no clause for directly taxing agricultural income. According to Section 10(1) of the Income Tax Act, agricultural income is not considered a means of income. Income generated from agriculture is exempted from taxation by the Central Government However, there is an indirect method of taxing that is levied on agricultural income.

While the Central Government cannot directly tax the income, the State Government is well within its right to levy a tax on agricultural income. The latest amendment mentions that the State Government can levy tax above the exempted rate, which is Rs. 5,000 in a fiscal year.

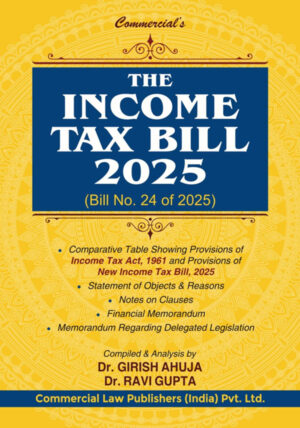

The book, placed in your hands, is a unique publication of its kind. It captures at one place, more than five hundred cases of contemporaneous relevance that are handpicked from reports and magazines that print virtually all that is published in India on the direct tax laws.

All the cases on the subject, delivered by different forums (SC, HC, ITAT & AAR), are arranged at one place to provide an easy and quick reference. Each case is systematically arranged brief with at least catch words for a quick reference and carries, wherever possible, the relevant assessment year.

Like any other good digest of case laws, the reader can reach to the desired case law by referring to any of the indexes on Case Laws, Section Subject and Chapter Further to avoid any confusion, the citations of the cases specifically highlight the respective judicial forums that delivered the decisions, while citing the cases. Care has been taken to refer to all the respective reports and the magazines while digesting the cases.

Although every effort has been made to support every information given in the book with the relevant sections and the rules of law, however the book should not be construed as an exhaustive statement of law. The relevant provisions of the Income Tax Act and the Income Tax Rules, may be referred to if necessary. Though every care has been taken to provide authentic information yet the authors/publisher are not legally or morally responsible for any loss or damage that may arise to any person from an inadvertent error or omission in the book. I, however always welcome suggestions and criticism from our esteemed readers for further improvement of the future editions of the book.

I would like to place on record a special note of gratitude to Shri Ashok Kumar Manchanda, IRS (1976-Batch) who has been the guiding force and a constant source of inspiration in my life. I also express my thanks to Commercial Law Publishers who reposed confidence in me and published this book. They have done a good job in making this book attractive, acceptable and useful.

I am sure this ready book will be of immense practical value and great use for the Advocates, Chartered Accountants. Tax Professionals, Tax Executives and Tax Authorities, alike.

Reviews

There are no reviews yet.