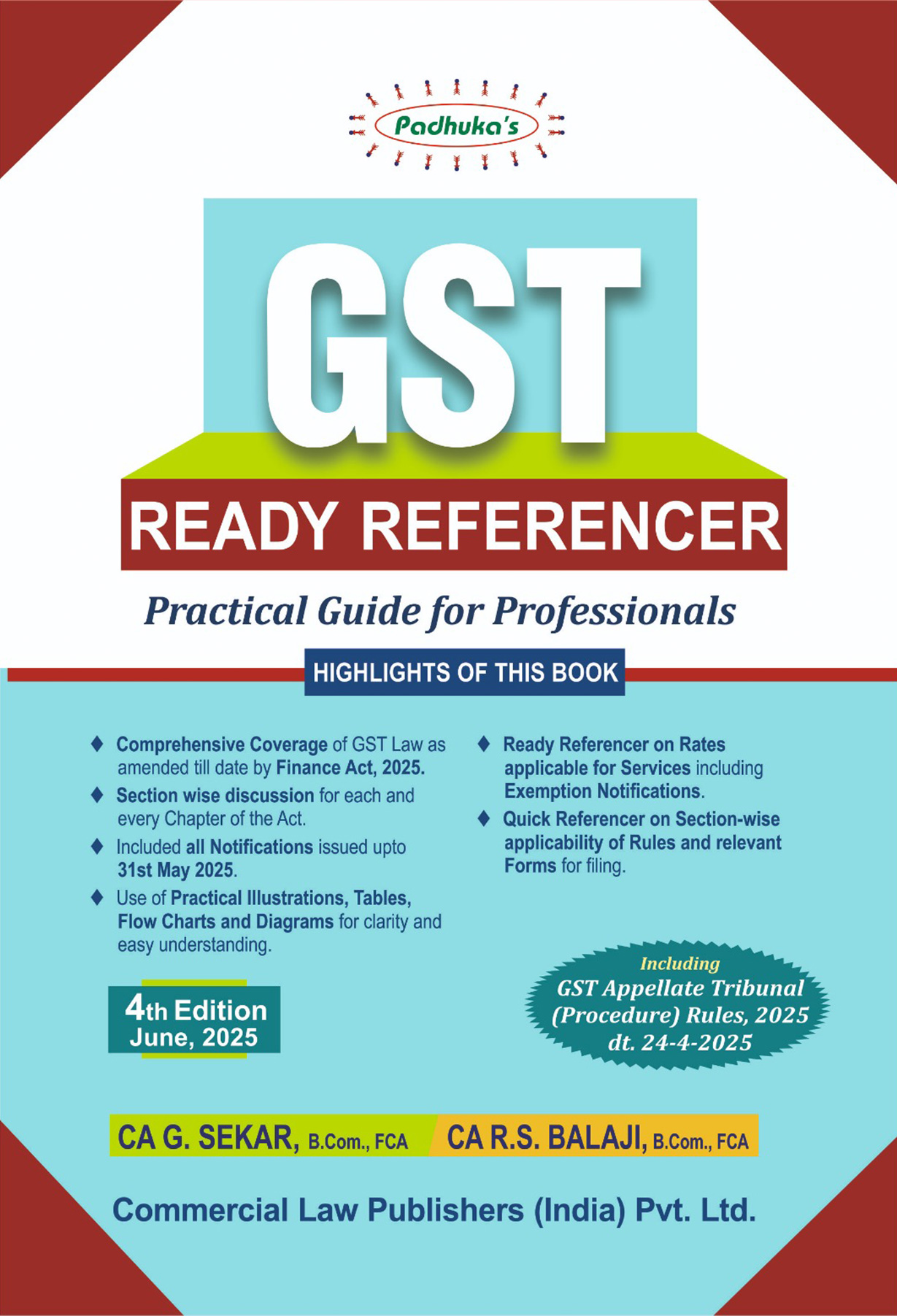

About the GST Ready Referencer

Chapter Description Page No.

Quick Referencer

Referencer on Section Wise Rules

Referencer on Section Wise Forms

Important SC, HC, AAAR Decisions

Changes by Finance Act, 2025

Definitions under CGST Act, 2017

R.1 – R.11

R.12 – R.23

R.24 – R.26

FA.1 – FA.6

D.1 – D.18

GST Law

1 Basic Concepts of GST 1.1 – 1.48

2 GST – Levy and Collection of Tax 2.1 – 2.130

3 GST – Exemptions 3.1 – 3.97

4 Place of Supply 4.1 – 4.48

5 Time and Value of Supply 5.1 – 5.66

6 Input Tax Credit 6.1 – 6.100

7 Registration 7.1 – 7.56

8 Tax Invoice, Credit and Debit Notes 8.1 – 8.32

9 Payment 9.1 – 9.40

10 Liability to Pay Tax in Certain Cases 10.1 – 10.8

11 Returns 11.1 – 11.54

12 Accounts and Records 12.1 – 12.10

13 Deemed Exports, Job Work, E–Way Bill 13.1 – 13.26

14 Administration Assessment Audit 14.1 – 14.28

15 Authority for Advance Rulings 15.1 – 15.22

16 Demand & Recovery of Tax 16.1 – 16.22

17 Refund of Taxes Paid 17.1 – 17.70

18 GST Inspection, Search and Seizure 18.1 – 18.16

19 Offences and Penalties 19.1 – 19.52

20 Appeals to Appellate Authority 20.1 – 20.40

GSTAT procedure Rules, 2025 20.41 –82

Reviews

There are no reviews yet.