About DIY GST Litigation Kit

Pre-drafted responses to below notices.

Ready for submission on adding company- specific details.

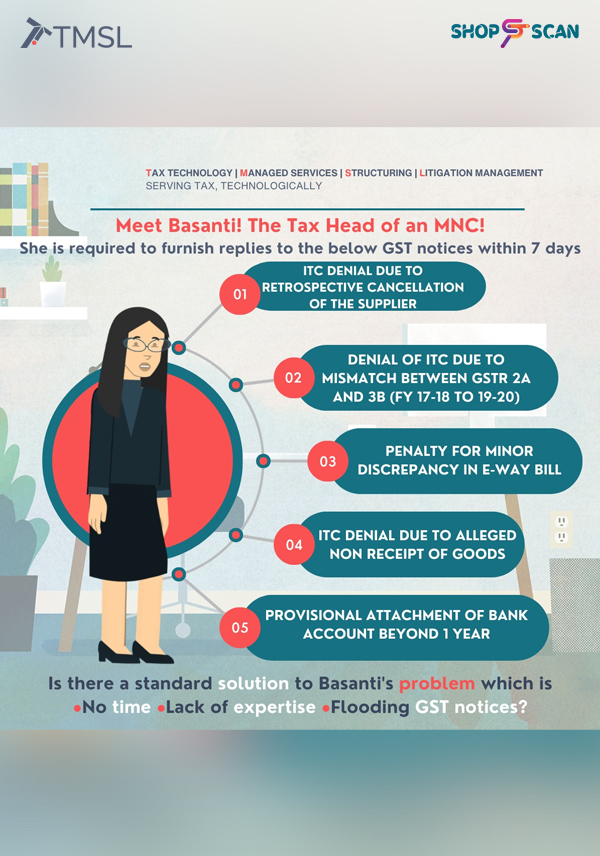

1. ITC Denial due to retrospective cancellation of the supplier

2. Denial of ITC due to GSTR 2A and 3B mismatch (FY 17 to FY 19)

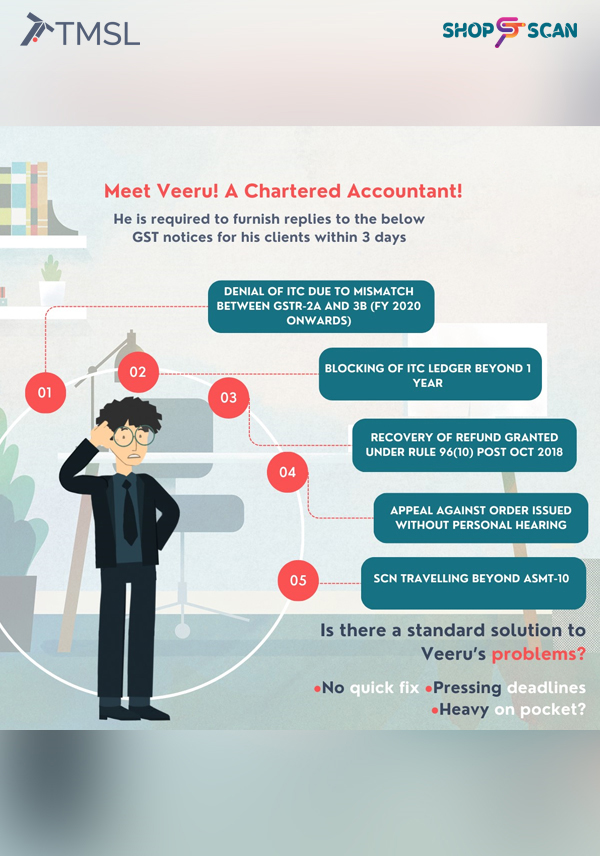

3. Denial of ITC due to GSTR 2A and 3B mismatch (FY 19 onwards)

4. ITC Denial due to alleged non receipt of goods

5. Denial of ITC due to non-filing of GSTR 3B by vendor

6. Penalty for minor discrepancy in E-way bill

7. Recovery of refund granted under Rule 96(10) prior to Oct 18

8. Recovery of refund granted under Rule 96(10) post Oct 18

9. ITC not availed within time limit of section 16(4)

10. Interest on ITC wherein payment to the vendor was made after 180 days

11. Appeal against order issued without personal hearing

12. SCN travelling beyond ASMT-10

13. Notice/Inquiry without DIN

14. Blocking of ITC Ledger beyond 1 year

15. Provisional attachment of bank account beyond 1 year

About the Author

CA Jigar Doshi – Founding Partner – TMSL

Jigar is the co-founder of TMSL. A Chartered Accountant with over 19 years of extensive work experience in the field of indirect taxation, Jigar is a visionary in automation and loves to move in line with the global trends.

His domain of expertise includes GST, Customs, erstwhile Indirect Taxes and UAE VAT legislations. He has substantial experience in advisory, compliance, refund assessments and representation, and litigation. He has assisted various corporates on the optimization of indirect tax costs and has been working with clients from industries with a focused approach on pharmaceuticals, FMCG, banking, FIIs, and information technology.

Jigar has several honours to his credit. He was awarded Young Accountant of The Year 2019 by IAB Awards at London. He was also a part of the 15-member Group of Ministers meet for simplification of the GST return process. He has trained esteemed government officials and is also an empanelled trainer at the National Academy of Customs Excise and Narcotics.

Jigar writes regularly for various journals and speaks at several forums including international ones. He has also been selected for the category of ‘Emerging Global Leaders’ across Middle East and Asia by CNBC. He has been a panellist for the program ‘Hello GST telecasted on CNBC, several times. He has also authored two books on GST Assessments and Audits in 2022 and 2023 respectively.

Reviews

There are no reviews yet.