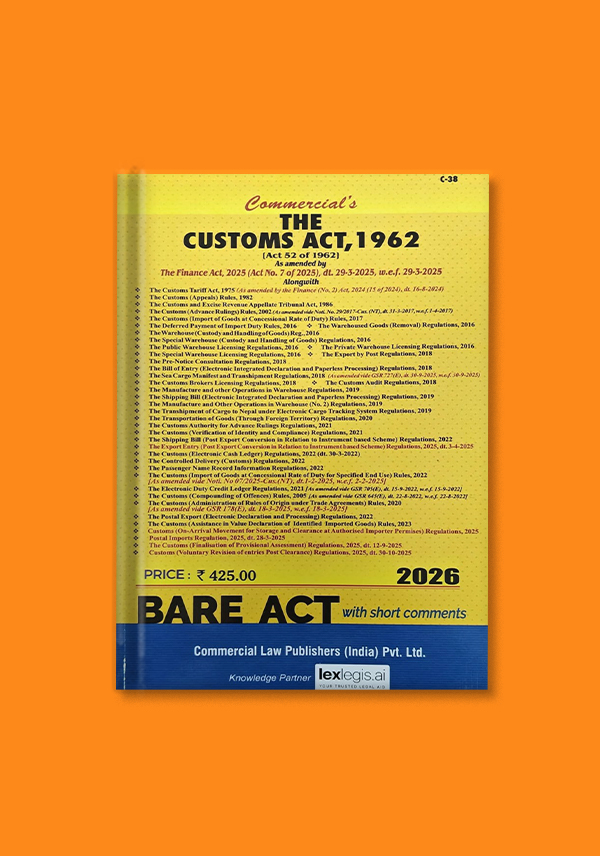

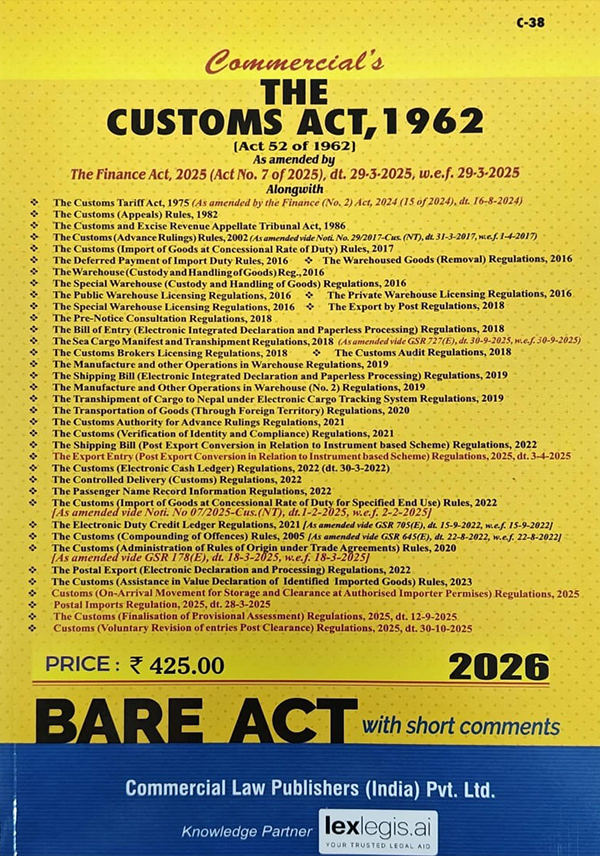

This edition of The Customs Act, 1962 (Act 52 of 1962) offers a comprehensive and up-to-date presentation of India’s principal legislation governing customs duties, import and export controls, and related procedures.

The text is updated with amendments introduced by the Finance Act, 2025, ensuring complete statutory accuracy and relevance to the prevailing customs law framework.

Along with the principal Act, this volume consolidates a wide range of allied rules, regulations, notifications, and procedures essential to customs administration and compliance.

These include provisions relating to customs tariff, valuation, duty drawback, warehousing, advance rulings, baggage rules, courier and postal imports and exports, special economic zones, coastal shipping, transshipment, manufacture and other operations in warehouses, faceless assessment, audit, verification of identity and compliance, electronic processing, and other procedural regulations governing customs operations.

The book is presented as a bare act, reproducing the legislative text precisely as enacted and amended, supplemented with short comments to aid clarity without departing from the statutory language. This format makes it particularly suitable for examination use, statutory reference, and practical application in professional settings.

This edition is especially valuable for law students, aspirants of judicial and competitive examinations, customs and indirect tax practitioners, chartered accountants, company secretaries, trade and logistics professionals, compliance officers, and academicians who require a reliable and current reference on customs law.

By bringing together the Act and its extensive regulatory framework in a single volume, this book serves as an authoritative resource on customs law as applicable in 2026.

Reviews

There are no reviews yet.